Foreseight

„You get over stimulated in Wall Street and you hear lots of things and you may shorten your focus and a short focus is not conducive to long profits.“

Warren Buffet (when asked why he stays away from Wall Street)

Microsoft co-founder Bill Gates once said that most people overestimate what they can achieve in a year and underestimate what they can achieve in 10 years. This assessment can be wonderfully applied to stock market performance. Generally speaking, we humans tend to prioritise the current and immediate anyway. In the case of asset accumulation, there is also the compound interest effect, which is chronically underestimated. We humans can only think linearly and not exponentially and therefore underestimate how crucial the time factor is for wealth accumulation. Warren Buffett, for example, invested in his first shares as a child and yet he only earned 99% of his current wealth after his 50th birthday - thanks to compound interest. For a better understanding, the power of compound interest can be illustrated using examples of calculations - the results are astonishing.

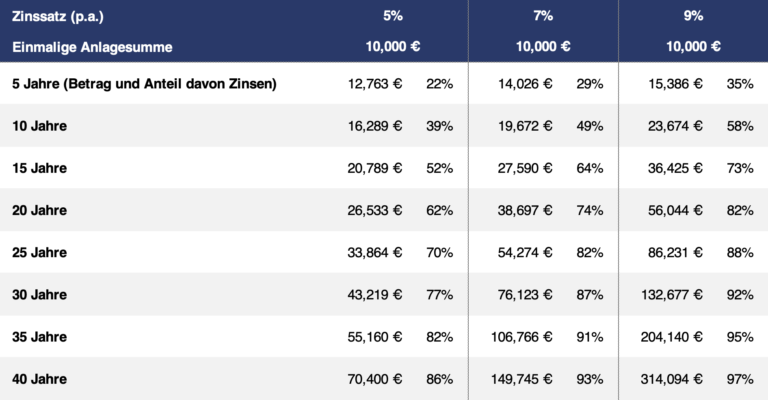

Source: Own calculations

The centre column of the table shows that €10,000 with an average interest rate of 7% will develop into €149,745 within 40 years. With a return of 9%, this amount more than doubles again to €314,094. In the latter case, the initial €10,000 invested represents just 3% of the final assets - 97% is generated through interest and compound interest. The ‘Rule of 72’ method can be used as a rule of thumb. It is a rough approximation of the time (in years) required for an investment to double at a certain rate of return. The number 72 is divided by the average annual return expected for the investment. So if we assume an annual return of 7%, it will take roughly 10 years (72 ./. 7) for the capital invested to double. At 40 years, that would be four doubling periods, i.e. 2^4 (16). Accordingly, the initial investment would increase sixteenfold, in this case from €10,000 to roughly €160,000. This roughly corresponds to the exact value in the table.

Unfortunately, many people are still leaving their money in their bank accounts and are therefore not only missing out on the opportunity to build up assets, but are even destroying value in the process in view of negative real interest rates. Against this background, it is advisable to start investing as early as possible and - at least as important - to think long-term so as not to lose sight of the goal in the distant future.

Unfortunately, many people are still leaving their money in their bank accounts and are therefore not only missing out on the opportunity to build up assets, but are even destroying value in the process in view of negative real interest rates. Against this background, it is advisable to start investing as early as possible and - at least as important - to think long-term so as not to lose sight of the goal in the distant future.