An old stock market adage says that it is better to stay away from companies with business models that are slowly but surely being replaced. The category of ‘slowly but surely being replaced’ undoubtedly includes linear TV. While some may be surprised at how slowly this decline is taking place, everyone can at least agree on the long-term trend: Linear TV is on the decline and the figures prove it.

A few months ago, I came across an interesting report by Gané (Go to Article), which deals with a special situation surrounding the RTL share. It is about the planned sale of the Dutch business and the associated potential for dividend hunters. Reason enough to take a closer look at RTL despite the impending decline of linear TV.

The deal: RTL sells its Netherlands business

RTL originally intended to strengthen its business with 8 channels and around 800 employees in the Netherlands through a merger with Talpa Network. However, this plan was thwarted by the antitrust authorities. In response, RTL decided to sell its entire Dutch business to DPG Media for 1.1 billion euros. However, the deal is still subject to regulatory approvals. This is another reason why RTL's share price is likely to have ‘risen by only 5%’ (to 34 euros at the time) when it is announced at the end of 2023. The result and closing are expected for the end of 2024. The buyer DPG Media is primarily active in the newspaper sector and has not yet been active in the Dutch TV market. Gané therefore considers a ban on the deal unlikely. Another positive aspect is that RTL and DPG have already worked together successfully in the past. RTL sold its Belgian business to DPG in 2022.

The dividend opportunity: normal and special dividends

What is exciting about this deal is the planned distribution to shareholders. For years, RTL has pursued a dividend policy whereby 80% of profits are distributed to shareholders. According to RTL, this also applies explicitly to the Dutch deal. Around 800 million of the sale price is tax-free. If 80% of this is distributed, this would correspond to a special dividend for shareholders of at least €4 per share (€4.12 to be precise). In addition, 80% of the net profit from ordinary business operations will be distributed. This is expected to amount to €2.75 per share in 2024.

Overall, shareholders could therefore benefit from a distribution of at least 6.75 euros per share. At a share price of around 29.50 euros (as at the end of August), this corresponds to a yield of 23%.

What happens if the deal falls through?

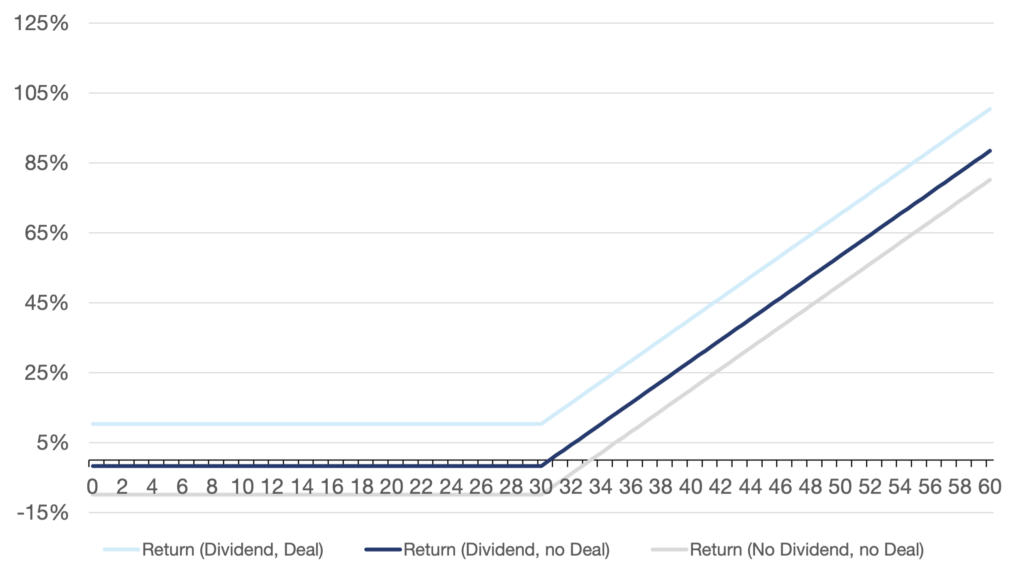

Of course, there is also a certain risk. If, contrary to expectations, the deal does not materialise, there is still the regular dividend of EUR 2.75 (scenario 2). This corresponds to a yield of around 9%. A scenario in which RTL pays no dividend at all (scenario 3) is possible, but I personally consider it extremely unlikely, as the Group's operating business remains stable according to its own information. Potential share price gains or losses are not taken into account here.

1) Ordinary dividend & Deal dividend = €2.75 + €4 = €6.75 (approx. 23% of the current price of €29.5)

2) Ordinary dividend & No Deal dividend = €2.75 + €0 = €2.75 (approx. 9% of the current price of €29.5)

3) No dividend at all = 0€ = 0% return

RTL share: scenarios without hedging

Hedging the price risk with put options

If you want to exclude the share price risk and focus exclusively on potential dividend payments, you can use options. DZ Bank warrants (ISIN: DE000DJ39HE5), for example, can be used. The strike price is €30 and the option can be exercised at any time as an American option until 20 June 2025 at the latest. With an announced dividend date at the end of April 2025 and a decision on the deal expected in 2024, this term offers sufficient flexibility.

The price of the warrant was € 0.38 at the end of August, with a subscription ratio of 10:1, which means a hedging cost of € 3.80 per share.

Although this hedge is relatively expensive (around 13% of the share price of €29.50), the downside risk can be effectively limited, with the exception of issuer risk. At the same time, there is the opportunity to profit from price increases. If the deal is successfully concluded (scenario 1), the share price is likely to rise accordingly and, in addition to dividend payments, share price gains are also on the cards. However, if the deal fails, scenarios 2 or 3 come into question.

1) Ordinary dividend & Deal dividend = 2.75€ + 4€ = 6.75€ - 3.80€ option costs + 0.50€ price gain (30€ - 29.5€) = 3.45€ (10% of the invested 29.50€ + 3.80€ = 33.3€)

2) Ordinary dividend & No Deal dividend = 2.75€ + 0€ = 2.75€ - 3.80€ option costs + 0.50€ price gain (30€ - 29.5€) = -0.55€ (-2%)

3) No dividend at all = 0€ = 0€ - 3.80€ option costs + 0.50€ price gain (30€ - 29.5€) = -3.30€ (-10%)

RTL share: scenarios with hedging

Conclusion: An exciting opportunity with a good risk/reward ratio

The potential deal between RTL and DPG Media offers an exciting opportunity for dividend hunters. If the sale is completed as expected, a substantial special dividend beckons, which, together with the regular distribution, enables a dividend yield of over 20%. At the same time, hedging with put options offers an opportunity to minimise the share price risk, albeit at the expense of performance.

Disclaimer: All information is at all times and without exception my personal opinion and judgement. No information, materials, services or other content provided on this website constitutes a solicitation, recommendation, endorsement or financial, investment or other advice. All information (forecasts, comments, hints, advice, etc.) is for educational and private entertainment purposes only. If visitors follow this advice, they act on their own responsibility.