“To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage but provides the greatest profit.”

Sir John Templeton

Market timing does not work, that is well known and scientifically proven. Annual forecasts also fall into this category. Fortunately, this realization is now quite widespread and at least some investment houses have completely dispensed with year-end price predictions. However, a well-founded assessment of the financial markets that highlights opportunities and risks remains an essential tool for investors. Under the motto “You can't predict. You can prepare.”, we take a look at the current situation and analyze how investors can position themselves. Translated with DeepL.com (free version)

US stock market under the microscope

The US stock market dominates the global markets. The S&P 500 rose by almost 25 % last year, having already gained 26 % in 2023. Since the 2007/08 financial crisis, the Nasdaq 100 (+894 %) and S&P 500 (+302 %) have clearly outperformed international indices such as the DAX (+161 %, note including dividends), MSCI Emerging Markets (+31 %) and the Euro Stoxx 50 (+14 %).

Chart 1: USA dominate

This performance has massively increased the US share of the MSCI World to over 73 % - a historic high.

Chart 2 & 3: USA determines the (MSCI) world

It is also worth noting that the ten largest companies in the S&P 500 now account for 39% of the index. This concentration surpasses both the “Nifty Fifty” era of the 1960s and the dotcom bubble of the late 1990s.

Chart 4: Top 10 more dominant than ever

And because high yields are attractive and are often extrapolated into the future, investors are predominantly invested in the USA - according to BoFa, this is the highest level since 2001.

Chart 5: USA highly weighted by investors

One of the main reasons for the popularity of the US market is the innovative strength of American companies, particularly the “Magnificent 7” (Apple, Nvidia, Alphabet, Meta, Amazon, Tesla and Microsoft). But not only have profits risen, valuations have also increased significantly. The price/earnings ratio (P/E ratio) of the S&P 500 is currently around 22.

J.P. Morgan Asset Management examined the monthly P/E ratios from 1988 to 2014 (almost 324 in total) and compared them with the annualized returns over the following ten years. The findings are:

- There is a clear relationship between the entry P/E ratio and subsequent ten-year returns: Higher entry valuations consistently lead to lower returns and vice versa.

- The current P/E ratio (22) is clearly in the top decile of observations.

- In den letzten 27 Jahren führten KGVs auf dem heutigen Niveau always to ten-year yields of between +2 % and -2 %.

Chart 6: Poor long-term prospects with high valuation

We are therefore observing extreme levels of concentration on the US market (in the MSCI World and within the S&P 500) and high valuations. This calls for caution. Up until two years ago, there were only four occasions in the history of the S&P 500 when the index returned at least 20% two years in a row. In three of these four cases, the index fell in the following two-year period. The exception was 1995-98, when the dotcom bubble delayed the decline until 2000, but then the index lost almost 40% in three years.

It is easy to explain why even the best companies and stock markets can only perform so well for a limited time. If we assume that American companies increase their profits by 7% p.a. on average, but the corresponding shares rise by two or three times this amount every year, then profits and valuations will diverge until a limit is reached at some point. As the discrepancy between earnings and valuation grows, the risk of a crash increases. Even the best companies in the world can become so expensive at some point that share prices collapse. The best example: the Nifty Fifty shares, which were the ultimate in the American economy in the 1960s and still ended up plummeting by over 90 % in some cases.

Nevertheless, not investing in the US market also entails risks. The highest returns are often achieved in the late phase of a bull market or bubble. Although the current valuation is high, it is not exorbitant and the trend towards passive ETFs means that billions continue to be invested in the most popular ETFs and therefore also largely in US equities. The evaluation by J.P. Morgan shows that valuation is not a timing instrument, but this time only with a view to performance over the next year (instead of 10 years). Here, months with high valuations were nevertheless often followed by a year with high returns.

Chart 7: High valuation less relevant in the short term

Sentiment also appears to be very positive, but not exuberant. Because apart from AI, there is currently no feeling that “no price is too high”. Quite a few professional fund managers are pointing to the expensive environment and are acting cautiously. The more cautious market participants are, the more room there is for upward movement.

Howard Marks shows in his latest memo (Link) that the current AI hype offers ideal conditions for a bubble to form. Normally, investors can fall back on historical valuations to recognize exaggerations. But with something completely new, this anchor function is missing. They are often guided by irrational thinking in bubbles because they believe in the new and think “this time it's different”.

- Historical bubbles:Tulip Mania (1630s) and the South Sea Bubble (1720) were based on the hope of new markets and technologies.

- 1960s:Nifty Fifty shares were considered the best and fastest growing companies in the world. The valuation did not matter.

- 1980s:Floppy disk drives were a revolution that raised enormous expectations.

- 1990s:TMT and internet stocks promised to change the world.

- 2004-2006Subprime mortgages were regarded as risk-free money machines.

It is therefore quite possible that the party will continue for American equities and that both concentration and valuation will continue to increase. However, investors should be aware that the “Magnificent 7” cannot dominate the world for all eternity. Within the US, therefore, a more balanced mix of stocks seems to make sense, some of which will benefit if the party continues, but are less dependent on the index heavyweights if they start to falter. Traditional stock picking could therefore experience a renaissance. For example, smaller stocks (small caps, e.g. Russell 2000 Index) are generally a good choice. They have fallen by the wayside compared to the S&P 500 in recent years and should still benefit greatly if the US equity market continues to perform. And even in the tech segment, there are still stocks that are unpopular and cheap and offer corresponding upside potential.

Chart 8: Small stocks relatively cheap

Values in the shadow of euphoria

“Rule number one: Most things will prove to be cyclical

Rule number two: Some of the greatest opportunities for gain and loss come when people forget rule number one”

Howard Marks

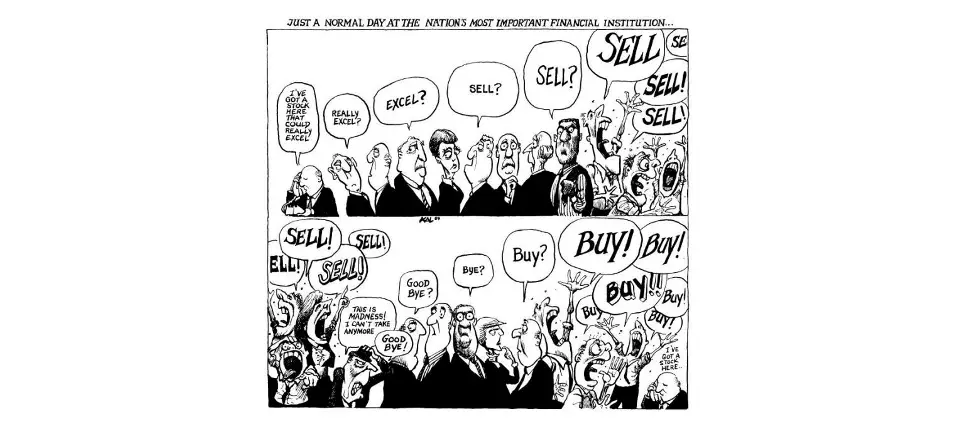

The concentration and high valuations in the US market make greater diversification more attractive - both geographically and by sector. So let's now take a look at the areas that are currently out of favor with investors. Despite the highs of many indices, there are still areas of the stock market that investors are avoiding. This is not atypical.

Companies, industries and entire markets go through cycles of good and bad times caused by a variety of factors, from economic change, technology and innovation to the human nature of greed and fear.

In a downturn, investors usually become pessimistic about the short-term outlook and there is extensive selling. Often these sell-offs are justified when structural challenges are involved, but in some situations the challenges companies face are cyclical in nature. This creates an opportunity for investors with a longer-term perspective.

In principle, the anti-cyclical investor loves stocks that are only avoided due to macroeconomic weakness, even though the company's business model is actually intact. It gets trickier with companies whose business model is threatened by innovation or competition. For example, when AI is currently making many business models superfluous or when better and cheaper providers are threatening traditional and usually slow industry giants. All of these areas deserve a closer look, as it is often precisely these shares that are available at low prices and offer enormous long-term opportunities for patient investors. The companies mentioned in the text are just examples and I am not invested in all of them.

Covid shares: the euphoria has faded

During the pandemic, many shares in the e-commerce and tech sector experienced massive hype, which has since evaporated. Some of the growth fantasies were exaggerated, growth was brought forward and reality has now caught up with many stocks. Nevertheless, the business models of companies such as Match Group, Bumble, Grindr, Fiverr and Upwork still have a raison d'être, as dating apps and freelancing are likely to remain in demand in the long term. German companies such as Westwing and Hellofresh are also benefiting from sustainable trends in consumer behavior.

Renewable energies: The story is intact

Shares in the renewable energy sector have fallen sharply following the pandemic boom. This is due to changes in the political environment and a return to traditional energy sources, which has brought a lot of joy to countercyclical investors. However, climate change remains a pressing issue: 2024 was the warmest year since records began, and the last ten years have generally all been the hottest in history (in descending order: 2024, 2023, 2016, 2020, 2019, 2015, 2017, 2022, 2021, 2018). In the long term, there is no way around the energy transition, which is why this topic should also come back into focus for investors sooner or later. Those who do not want to pick stocks can switch to sector ETFs. One of the positive outliers last year was Siemens Energy, which gained almost 320% in 2024, making it the clear leader in the DAX.

Chart 9: iShares Global Clean Energy ETF

Classic energy and raw materials: proven values

Energy and commodity stocks remain interesting as the world needs more and more energy - mainly due to technological developments. Stocks such as Chevron, Occidental Petroleum, Total and Shell are likely to continue to dominate the energy sector in the coming years and are also involved in renewable energies. In the commodities sector, the same should apply to Vale or BHP. Commodity stocks should benefit in particular if inflation remains high. If the economy weakens and the Fed has to cut interest rates to stimulate the economy, the strong US dollar should come under pressure and commodity stocks should also benefit. Gold miners such as Barrick Gold are also favorably valued relative to the gold price and often have additional exposure to other commodities such as copper.

More defensive stocks with setbacks

Defensive stocks from the pharmaceutical sector such as Pfizer or Roche, which are not directly benefiting from the Ozempic hype, are currently neglected. Alcohol manufacturers such as Diageo, Pernod Ricard and Aperol producer Campari, which are suffering from consumer restraint and structural headwinds, are in a similar situation.

Chart 10: Spirits producers with headwinds

Heavyweights such as Nestlé are also trading weakly and could be in greater demand again in the event of market turbulence. In general, consumer staples stocks are even weaker than they have been since 2000 compared to the overall index. Outperformance can be expected in the event of market turbulence.

Chart 11: Consumer Staples vs. S&P 500

Car and luxury stocks with problems

Car and luxury stocks, such as BMW, Mercedes, LVMH and Kering, were already mentioned in the last article (Link) are being discussed. These sectors face challenges, but remain promising in the long term, especially if consumer sentiment in China improves again.

Emerging markets and China: weakness with potential

Equities from emerging markets, particularly China, are suffering from extreme weakness and negativity. But it is precisely here that long-term opportunities could open up for courageous investors. There were also a few lines about this in the last blog article.

Conclusion

The high concentration and ambitious valuations, particularly in the US market and among index heavyweights such as the Magnificent 7, are a warning to be cautious. After two exceptionally strong years in 2023 and 2024, expectations for 2025 could be exaggerated, increasing the risk of both a correction and further overheating.

Investors are therefore particularly interested in those companies and sectors that are currently underestimated by the market - whether due to negative narratives or temporary macroeconomic weaknesses. These neglected sectors often offer an attractive risk/return profile and could benefit disproportionately in the event of a market rotation or economic recovery. Ultimately, foresight and a smart approach to opportunities and risks remain crucial for investment success.

Of course, the entire furor over technology, e-commerce and telecom stocks stems from the companies‘ potential to change the world. I have absolutely no doubt that these movements are revolutionizing life as we know it, or that they will leave the world almost unrecognizable from what it was only a few years ago. The challenge lies in figuring out who the winners will be, and what a piece of them is really worth today. ..To say technology, Internet and telecommunications stocks are too high and about to decline is comparable today to standing in front of a freight train. To say they have benefited from a boom of colossal proportions and should be examined very skeptically is something I feel I owe you.

Howard Marks in his Memo “Bubble.com” from January 3, 2000

To the 2024 annual review: https://investmentphilosoph.com/maerkte-2024-bewegtes-jahr-ohne-richtungswechsel/

Disclaimer: All information is at all times and without exception my personal opinion and judgement. No information, materials, services or other content provided on this website constitutes a solicitation, recommendation, endorsement or financial, investment or other advice. All information (forecasts, comments, hints, advice, etc.) is for educational and private entertainment purposes only. If visitors follow this advice, they act on their own responsibility.